Reaching Your Goals

Tuesday, January 1st

As another new year rolls around, you might be like a lot of Americans, and decide it’s a good time to set some new goals or make some resolutions. Though we can make new goals at any time, the start of a fresh new year seems like the perfect time to make a few changes in our lives.

As another new year rolls around, you might be like a lot of Americans, and decide it’s a good time to set some new goals or make some resolutions. Though we can make new goals at any time, the start of a fresh new year seems like the perfect time to make a few changes in our lives.

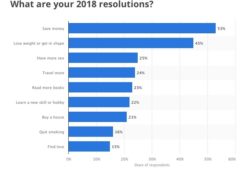

Last year, saving money was the number one resolution made by Americans. A great idea for all of us. The trouble is, that by the second week in February, 80% of people have already given up on their resolutions and in the end, only 8% of resolutions are ever accomplished.

Last year, saving money was the number one resolution made by Americans. A great idea for all of us. The trouble is, that by the second week in February, 80% of people have already given up on their resolutions and in the end, only 8% of resolutions are ever accomplished.

It’s easy to see why. We all know that feeling when we’re making a goal—the deep desire to change, the happy hope that we can get a different or better result in our lives. What we are less acquainted with is the feeling of discomfort that accomplishing those changes requires.

This part (the hard part) is easy to underestimate as we set our goals. But, anytime we decide to alter our behavior, in any area of our lives, it’s going to be a little painful. It’s going to feel difficult and uncomfortable. As the weeks wear on and we realize it’s not getting any easier, we wonder why we’re making the effort, and 92% of us give up.

The thing to remember is that if it wasn’t hard, we’d already be doing it. The fact that your goal is causing you discomfort or stress in your life, does not mean that anything has gone wrong. In fact, for those of us really wanting to make a change, it means that everything is going exactly right.

We hope that this year you will set some goals that will move you closer to your retirement dreams. And that, even when it starts to feel uncomfortable or difficult, you will think about “the why” you are doing it to help you when “the feelings” start to let you down.

Here are a few things to keep in mind as you think about your financial goals for the new year:

Have a conversation with Future You – Those people who get to retirement with regrets have not spent enough time considering their future selves. They have sacrificed all their future needs and wants for today’s. It can be helpful to imagine yourself in the future, at the point of retirement and ask yourself a few questions.

Where are you living? Is your house paid for?

How much money do you have? Are you just getting by or are you able to travel and spoil the grandkids?

Is paying for healthcare a worry or are you prepared?

What do you drive?

What do you wear?

What do you do for entertainment and fun?

Do you worry about money?

Do you wish you would have done things differently?

I would encourage you to really think about those answers. How will Future You answer them? If you don’t like the answers or find yourself thinking “I don’t know” for many of them, it’s an indication that more planning, thought, and preparation is in order. You get to create any retirement scenario you want. Be mindful and intentional about the one you are planning and preparing for. Have a clear vision of where you are going. Envisioning your goal, the place where you will actually be someday, can make any discomfort in keeping your commitments to yourself much more bearable.

There isn’t a point at which it gets easier – We hear over and over again how because of this contingency or this situation, people just weren’t able to prepare for retirement like they wanted to. Too many times we are waiting for it to get easier, waiting for things to get better, for that raise to kick in, for the kids to leave home, or to finish paying for college, before we start earnestly preparing for life without an earned income.

We can tell you from experience, there isn’t any point at which it gets easier for anybody. Like any goal, it will always come with a bit of discomfort. It will always feel like a stretch, it will always reduce the rest of your budget, and it will always feel like other needs are more pressing. There’s no way around it.

As humans, we like to believe (no matter what our goal) that “there has to be an easier way.” There has to be an easier way to lose weight or learn a language or get up earlier or stop smoking. Wishing for an easier way doesn’t mean we’re weak or we’re flawed in some way—it just means we’re human. Our brains are programmed to seek pleasure, avoid pain, and save energy. None of which makes “the hard way” desirable in any way. It’s good to just be aware of this natural tendency and to know that there isn’t ever going to be an easier way. It’s just going to be hard sometimes. Be ready for it.

Fall in love with the process, not the results – Finally, I think it’s also very helpful to focus on the process of saving and preparing for retirement, instead of only noticing the results. The truth is (as with any goal) the results are going to accumulate slowly over time. This imperceptible progress is challenging for most of us.

For example, if you start a new exercise regimen in hopes of losing weight, but don’t see a big, immediate change in the mirror, people have a tendency to give up. “It’s not working,” we reason. The fact is, change in our bodies (or change in our bank accounts) take years to accomplish. It’s always a much longer process than we usually anticipate.

If instead, you focus on the fitness process—building strength, increasing stamina, developing consistency, showing up even when its hard or feels futile—you will appreciate what you are learning and who you are becoming as a result of doing the work day after day.

Preparing for retirement is no different. People who only focus on results burn out fast because they are seeking outside validation in order to feel like all the sacrifice and discomfort is worth it. When they don’t see fantastic, immediate results—with bulging bank accounts or mind-blowing investment performance—their motivation and drive wane and they are more likely to give up.

However, by focusing on the process itself—developing discipline, creating a plan, noticing small gains, practicing patience—you will be able to generate the power you need to stay the course long-term.

What a difference a year can make! We hope you will take the opportunity as we start a new one to evaluate where you are now and where you want to be in the future…both at retirement and by the end of this year. Remember, you will create those future results one day and one decision at a time.

At Acute Wealth Advisors we are here to help you reach all your goals. Now is the perfect time to prepare for your retirement and we’re here to guide you through the process. Call us today to set up an appointment. It’s time to start achieving your goals!