A Note from President George H. W. Bush

Wednesday, December 5th

I am sure you have heard or read of the recent passing of President George H. W. Bush.

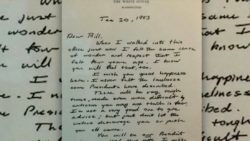

Of all the things that have been said and written of him, my favorite is a letter he wrote in his own hand and left on the desk of the oval office for President Clinton as he came into office. After losing the ’92 election to Clinton, he wrote:

Dear Bill,

When I walked into this office just now I felt the same sense of wonder and respect that I felt four years ago. I know you will feel that, too.

I wish you great happiness here. I never felt the loneliness some Presidents have described.

There will be very tough times, made even more difficult by criticism you may not think is fair. I’m not a very good one to give advice; but just don’t let the critics discourage you or push you off course.

You will be our President when you read this note. I wish you well. I wish your family well.

Your success now is our country’s success. I am rooting hard for you.

Good luck—

George

No matter your political persuasion, this note speaks volumes of the dignity and grace that characterized President Bush.

As I have reflected on it, I was particularly struck by the thought about not letting the critics discourage us or push us off course. Whether or not we hold political office, all of us are subject to the judgements and well-meaning criticism of others. I think this especially true when it comes to our money—the way we earn it, the way we spend it, the way we save it, or the way we have made perceived “mistakes” with our money. It seems everybody has an opinion.

As we pointed out in the October blog, even Warren Buffet, who knows more about it than just about anybody, gets criticism about how he handles money. The key, I think, when considering these criticisms and judgements is to remember President Bush’s advice: don’t let it discourage you and don’t let it push you off course.

Don’t let it discourage you – Remember that your retirement plan was created specifically so that you can play the long game. Just as it took time to earn and save your nest egg, it takes time to see the benefits and strategies of your retirement plan working to full effect. Don’t be deterred by slow progress or long-term objectives.

For example, if you are in the process of reallocating some of the money in your tax-deferred accounts into tax-free accounts, it can take many years to systematically move the money in the right ratios, in order to minimize any negative tax consequences. Tax efficiency strategies can also require you to pay more in taxes right now in order to avoid a larger tax bill later on.

This approach can seem counter intuitive to many and you may receive some criticism for “paying more taxes than you need to.” But if you patiently work to move money into a variety of vehicles with different tax consequences, it can pay off in a big way for you down the road because tax laws and brackets are always subject to change.

There are a lot of people who think they are experts with money. However, they are not experts with your money. For instance, an annuity may be the obvious choice for one retiree wanting to maximize income efficiency, while for someone else who doesn’t need a guaranteed income stream it can be an unnecessary and unwise way to invest.

Don’t get discouraged or frightened by the critics or “experts” who throw around “absolutes.” The truth is, your retirement is just that…yours. Design your plan with a knowledgeable professional that can help you make the best decisions when it comes to investing with minimal fees, setting up tax efficiencies and income efficiencies, and making your money last as long as you need it. Then execute it with undeterred enthusiasm and confidence.

Don’t let it push you off course – I recently heard a podcast that interviewed a famous athletic trainer about the biggest mistakes people make with their health and fitness. The trainer didn’t hesitate. He said the biggest error we make is jumping from program to program, changing our fitness protocols before they’ve had a chance to work. He pointed out that we want immediate results and instead of giving our bodies time to adjust and respond. Instead we just decide it’s not working and move on to something else.

It’s no different when it comes to our money. We want quick results without a lot of pain or difficulty involved. To illustrate, as our clients near and enter retirement we advise them to pursue a more conservative investment strategy to protect their nest egg from sudden, catastrophic downturns.

But naturally, with this strategy in place, returns are often slower and even boringly consistent. Sometimes people want to give up and try something else before they’ve had a chance to really adjust and observe the less obvious benefits of such a prudent approach.

The fear of missing out or not doing as well as they see other people doing with a more aggressive approach, tempts some to impatiently jump ship and try something else. The problem is that when you switch from strategy to strategy in search of the golden goose, you lose all the benefits of consistency and pay a steep price in both risk and fees.

Don’t let other people’s strategies or ideas push you off course from your own well-researched, well-organized plan. Again, your retirement plan is unique to you and your circumstances. Find a retirement advisor you trust and listen to their advice exclusively rather than the myriad of opinions and voices that are out there. As the saying goes, have one teacher or master at a time. It’s just as true when it comes to money as with anything else.

By sticking to your retirement goals and pursuing your carefully designed plan with confidence and tenacity, you will achieve the results you have worked so hard for. And here at Acute Wealth Advisors we are rooting hard for each one of you.

If we can help encourage or assist you in getting on the right course for your retirement, contact us today.