Newsletter

NEWSLETTER: JUNE 2023

Wednesday, August 2nd

Hello valued client,

Brief Market Update: Please take a few minutes to read some brief comments on the markets and the current economic recession indicators.

- CPI MEETS EXPECTATIONS: The latest CPI number of 4.0% was in-line with expectations and shows that inflation continues to drop. The FED announced a pause in rate increases but surprised the markets by announcing the possibility of two more rate increases of .25%. The FED expects to keep rates at current or higher levels through 2023.

- MARKET DIVERGENCE IS AT EXTREMES: The S&P 500 performance in 2023 has been quite unusual with the majority of the growth coming from just eight stocks. 97% of all of the growth in the S&P 500 has been due to these eight stocks while the remaining 492 stocks continue to trend downward or flat YTD. This type of extreme disconnect (just a few stocks rallying) is usually short lived with the outperforming stocks falling rapidly to join the rest of the market. Our indicators are flashing signals that this recent divergence is at extreme levels and a correction of these eight stocks is likely.

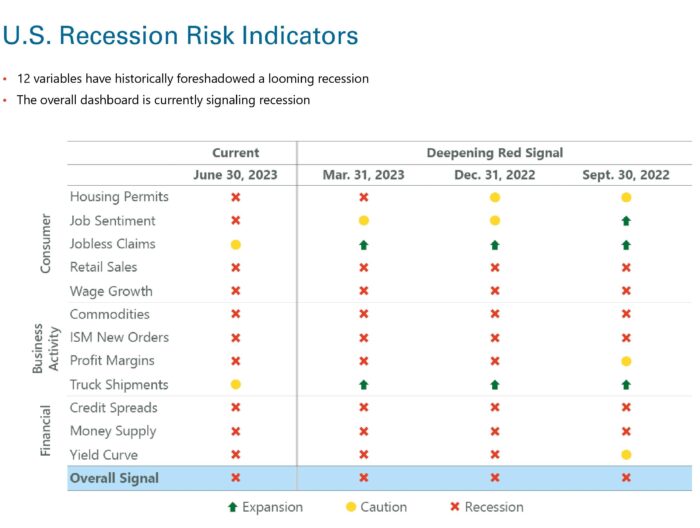

- LATEST ECONOMIC INDICATORS: As of May 31st , there are still 10 indicators signaling Recession and two signaling Caution. The job market has remained more resilient than the FED or economist had expected which has pushed out the possibility of a recession to later this year or early 2024.

Below are the latest economic recession indicators as of May 31 st .

(The chart below shows the indicators in past recessions as a comparison.)

All the best,

Matt Deaton, Managing Partner

Acute Wealth Advisors

4856 E. Baseline Rd., Suite 104 | Mesa, AZ 85206

P: (480) 620-6907 | F: (800) 537-4185

Investment advisory services offered through Acute Investment Advisory, a Registered Investment Advisor. Insurance and annuities offered through Acute Wealth Advisors, LLC.