Newsletter

NEWSLETTER: AUGUST 2023

Tuesday, August 15th

Hello Valued Client,

Brief Market Update: Please take a few minutes to read some brief comments on the markets and the current economic recession indicators.

- MARKET IS SHOWING SIGNS OF A CORRECTION: As noted in our last quarterly update, most of the growth in the S&P 500 in 2023 has been attributed to just eight stocks. We have been expecting these market leading stocks to begin to weaken which it looks like we are starting to see. For example, over the past 3 weeks Apple stock has dropped over 10%. It is likely this trend continues until the outperforming stocks drop to be more in-line with the rest of the market.

- CPI MEETS EXPECTATIONS: The latest CPI number of 3.2% shows that inflation has increased slightly due in part to rising oil and gas prices. The FED has signaled that they are inclined to keep rates steady but may be forced to reconsider another rate increase if inflation continues to increase. The FED’s rate decision could be a major catalyst during Q3.

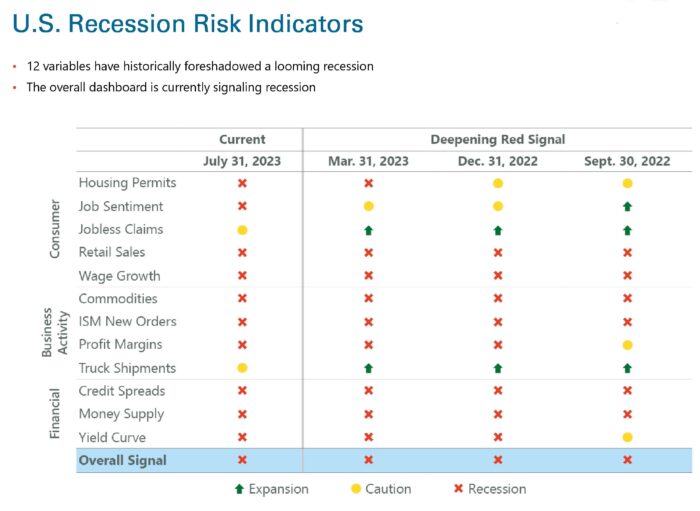

- LATEST ECONOMIC INDICATORS: As of July 31st, there are still 10 indicators signaling Recession and two signaling Caution. While some economists have forecasted that the US will avoid a recession, the probability of a recession remains above 65%.

Below are the latest economic recession indicators as of July 31st.

All the best,

Matt Deaton, Managing Partner

Acute Wealth Advisors

4856 E. Baseline Rd., Suite 104 | Mesa, AZ 85206

P: (480) 620-6907 | F: (800) 537-4185

Investment advisory services offered through Acute Investment Advisory, a Registered Investment Advisor. Insurance and annuities offered through Acute Wealth Advisors, LLC.