HOW POSSIBLE IS YOUR RETIREMENT DREAM?

Thursday, August 1st

Last week there was lots of media coverage about the 50-year anniversary of the first moon landing.

As I have thought about the audacious Apollo 11 endeavor, I have been amazed at the magnitude of the challenges they faced in order to make this landing. For example, I have read in several sources that the computers that were used to complete the mission were even less complex than a basic calculator.

According to one article, the astronauts typed their commands using verb-noun instructions: the verb specified the action that the astronauts needed the noun to take, like “aim telescope.” To do this the Apollo mission computer required 64 kilobytes of memory. That means that an ordinary USB memory stick sitting in the bottom of my daughter’s backpack is more powerful than the Apollo Guidance Computer that empowered the mission to the moon.

And this is just one of many challenges these astronauts and scientists faced. In fact, when you consider the logistics, the planning, the mathematics, the technology, the coordination, and the dangers involved in the mission, it seems overwhelmingly impossible.

I think the famous line that Neil Armstrong said after those first steps on the moon were the key to all of it: “That’s one small step for man, one giant leap for mankind.” I believe that the only way these men and the teams back home were able to create the “impossible” was by taking it one step at a time. In other words, the moon landing happened, despite the monumental challenges preventing it, because the men and women involved broke it all down and accomplished a small goal over and over again.

It is no different for each one of us as we prepare for retirement. From our first day of work to where we need to be in order to successfully land our retirement seems about 239,800 miles away. The planning, the logistics, the mathematics, the persistence, the consistency, and the coordination it will require are almost as staggering.

But again, it becomes totally doable when broken down into one small goal at a time. Here are a few “small steps” that I believe will create “giant leaps” over time towards reaching your retirement goals:

Save Early and Often – The earlier you can begin consistently saving towards your retirement the bigger leaps you will see in your retirement account balances.

I’m sure you have heard the story about Warren Buffett when the lightbulb went off for him regarding compound interest. When he was 11-years-old, he read One Thousand Ways to Make $1,000, which he found on a shelf of the local public library. His biographer, Alice Schroeder, wrote that as he read the passage on compound interest “he could picture the numbers compounding as vividly as the way a snowball grew when he rolled it across the lawn.”

The point is that no matter where you are in rolling your snowball, whether you are just starting or if your snowball isn’t as big as you would like it to be, the faster you begin rolling, the better off you’ll be. So start today. Stop waiting and spending time in regret. Just get rolling your snowball as consistently and rigorously as you can.

Small increases here will make a big difference over time as well. Consider making a 1% increase in your savings or retirement contributions every year. A 1% increase will make very little difference in your household budget, but it will add up to much bigger returns that will compound over time.

A Reduction in Fees is as Good as an Increase in Returns – Every day I talk to clients who are solely focused on getting the best returns on their investments. I understand that completely. We all want to get the very best returns we can.

What most clients don’t understand is that while they have very little control over the market, there is still one seemingly “small” way for them to make a big leap on the rate of their returns—and that is in reducing the fees of their investment accounts. Because reducing your fees even by 1-2% is as good as a 1-2% increase in your returns and so much easier to attain.

Reducing your investment fees will impact your portfolio in many ways. Countless studies have shown that the amount you pay is indirectly related to the success of your returns. In other words, the lower your fees, the better your returns will be.

Not only that, but just like in compounding, the small differences you pay in fees can make a huge difference over time. Because investors’ fees are paid annually as a percentage of the portfolio’s value, the larger your portfolio gets, the more you will pay in fees.

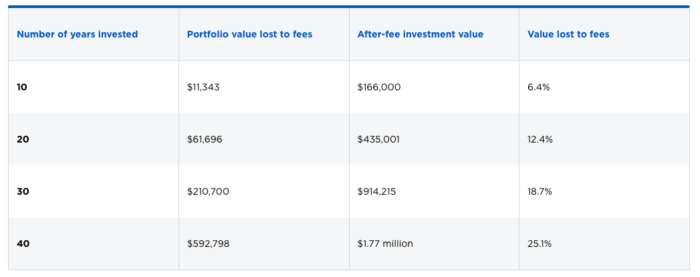

In this table from NerdWallet you can see that the longer you are invested the higher the losses. From 20-40 years, the loss to fees increases from 12% to over 25%.

Even though the investor continues to get the same 7% average annual return, Nerdwallet’s analysis showed the percentage of value lost to fees climbs higher as the years pass.

Reducing your fees by 1% may seem small, but over the course of 40 years, the impact of that 1% is more than $592,000.

If you don’t know what fees you are paying, you need to. We can help you do that and make the small changes that will result in big dividends over time.

Make a Plan to Wipe Out Your Debts – Obviously, any money that you aren’t giving to someone else, can be invested towards your retirement future. Instead of putting your hard-earned dollars towards paying interest, those dollars could be busy earning interest.

When it comes down to it, your best wealth-building tool is your income. The less debt you have, the more of your income is actually yours to use the way you want. This is why we recommend that eliminating debt as quickly as possible while still maintaining your savings goals. The faster you can free up that money, the faster you can put it to work for you rather than having it work for someone else.

Meet with a Fiduciary Financial Advisor – A lot of people are hesitant to seek help with their retirement plan. They are afraid that it will cost them too much money or that they don’t have a big enough portfolio to qualify for professional help. Too many people try to navigate retirement on their own.

This is another small, easy step that can make a huge difference for your retirement outcomes. A fiduciary financial advisor is required to have your best interest in mind and they can identify exactly where you can make small changes in fees, portfolio makeup, risk strategies, tax implications, and income efficiency that can make a world of difference in the health and growth of your overall portfolio. They can help you find all the little leaks as well as see the big picture and what you need to do to get there.

Just like the Apollo crew needed a team of people to help them prepare and manage challenges along the way, the right financial advisor can help you make the “impossible” a reality.

At Acute Wealth Advisors we know the value of small steps that will allow our clients to achieve their big retirement dreams. This is exactly why we’re in business. Please contact us today to see if we can make a difference in your strategy to successfully land your retirement.