THE AGGREGATION OF MARGINAL GAINS

Wednesday, May 1st

I have recently enjoyed reading Atomic Habits by James Clear. In the book, Clear talks about how the smallest changes and efforts that are made over time can have an enormous impact on the outcomes of our lives.

At the beginning of the book, Clear relates how the British cycling team had such lackluster results in major, world cycling competitions like the Olympics and the Tour de France, that several reputable bike manufacturers refused to sell to the Brits for fear their dismal results would reflect poorly on their brand. In fact, since 1908, British riders had only won one gold medal at the Olympic Games, and no British cyclist had ever won the Tour de France.

But in 2003, the British Cycling organization hired Dave Brailsford as its new performance director. Brailsford’s strategy was to improve the team through what he called “the aggregation of marginal gains.” The idea was that, as Brailsford explained, “…if you broke down everything you could think of that goes into riding a bike, and then improve it by one percent, you will get a significant increase when you put them all together.”

The team broke everything down and tried to get a 1% improvement everywhere they could—from training and race strategies, to the fabrics the riders wore, to changing the massage gels for faster recovery, to getting new mattresses, and even repainting the inside of the team truck to show dust that could degrade the finely tuned bikes. They left no stone unturned.

Clear wrote, “As these and hundreds of other small improvements accumulated, the results came faster than anyone could have imagined.” Within five years, British Cycling dominated the Beijing Olympics games as well as the London games four years after that.

Clear notes that the results speak for themselves: “During the ten-year span from 2007 to 2017, British cyclists won 178 world championships and 66 Olympic or Paralympic gold medals and captured five Tour de France victories in what is widely regarded as the most successful run in cycling history.”

All of this was accomplished by aggregating and accumulating tiny gains—added together, they all made an impact on the British Cycling team’s performance.

We often discount the power of small wins or improvements, but over time aggregating these small wins and accomplishments is the way we will achieve our goals. Being successful in your retirement plan works exactly the same way. Through the accumulation and aggregation of small, even 1% improvements, you can make a big difference in health and size of your retirement accounts.

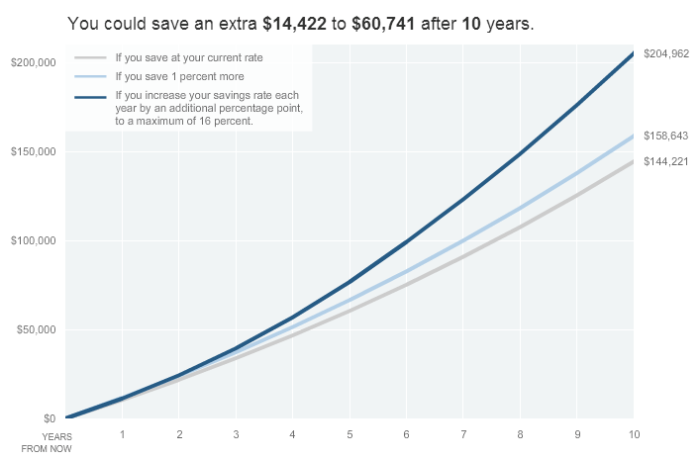

Think about the difference of saving an extra 1% a year. It probably wouldn’t make a noticeable change in the operation of your household budget, but it could make a really big difference in the size of your retirement funds over time.

The New York Times published this calculator to demonstrate. It shows what can happen over 10 years if you increase your savings by 1% and also what happens if you increase your savings by 1% every single year:

In addition to a small increase in your savings rate, there are other little things that you can do to make a big difference in size of your retirement account.

THE LITTLE THINGS THAT MAKE A BIG DIFFERENCE

Fees – Most people have no concrete idea what they are paying in fees for their retirement accounts. But, it’s important to have a thorough understanding of every fee you are paying so that you can decide if they are worth the price.

Remember, improving the amount you pay in fees, even a by a few percentage points, can aggregate into big wins over time. The Center for American Progress estimates that an average investor pays over $138,000 in fees over their lifetime. Reducing this amount will directly impact the size of your nest egg.

Most people believe that they don’t have fees associated with their 401(k) because it is a “benefit” that is provided by their company. However, most funds options inside of a 401(k) are mutual funds which have several fees that can add up quickly.

While it may seem overwhelming to know where to begin when it comes to fees, at Acute Wealth Advisors, we are happy to show you exactly how much you are paying in fees and exactly what you are getting in return. With an accurate picture in place you can then make better decisions about where to get small but significant decreases in your fees to help you reach your retirement goals.

Taxes – We just finished tax season and so I know the amount you pay to Uncle Sam is fresh in your mind. While most of us are socking away a large chunk of our retirement funds into tax-deferred accounts, it’s important to think about all the ramifications of this strategy.

Generally, people put money in a tax-deferred account like a 401(k), assuming that they will have less income in retirement and that when they withdraw their money, the tax-deferred money will then be theoretically taxed at a lower tax bracket than they are in currently.

However, the tax code is subject to change. In some cases, it is possible that you may end up paying more in taxes later than you would now, depending on changes in the tax code, how much you receive in Social Security, and how much you have to withdraw because of Required Minimum Distributions (RMDs).

It is wise to have a diversified tax strategy with some money in tax-deferred accounts and some money in tax-free accounts so that you can adjust to whatever tax laws are in place during your retirement. Being able to save even a small percentage of what you pay in taxes will add up and allow you to have more income during retirement.

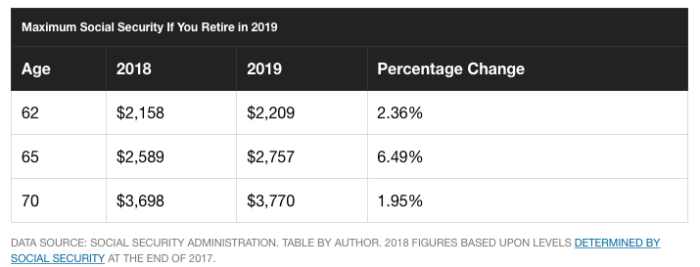

Social Security – Whenever possible, I encourage people to wait as long as possible to begin taking their Social Security benefits. If you end up taking benefits before your full retirement age you will reduce the amount of your benefit by as much as 30%.

On the other hand, if you delay taking your benefits until after your full retirement age you can increase your benefit by 8% per year. This can be the difference of tens of thousands of dollars in income over your lifetime.

This chart, published by The Motley Fool, clearly demonstrates the increased monthly income you receive by waiting until full retirement and beyond to receive your benefits.

Planning and preparing for retirement is a long process. Given the amount of time involved, little changes and adjustments and savings can add up and make a huge difference. Even if you are already in retirement, chances are you could be there for a long time and any changes that you make in the amount of fees or taxes you pay at the beginning and throughout retirement, can save you thousands of dollars over your lifetime and allow your money to last.

At Acute Wealth Advisors, we care about the little things because we know they add up and make a huge impact on your overall retirement plan. We are here to help you sort out every tiny detail of your personal plan so that you can make the small, but significant, adjustments to reach all your retirement goals. Call us today and see the big difference little improvements can make!