Newsletter

NEWSLETTER: NOVEMBER 2023

Friday, November 17th

Hello Valued Client,

Brief Market Update: Please take a few minutes to read some brief comments on the markets and the current economic recession indicators.

- MARKET VOLATILITY HAS INCREASED: The market dropped by over 10% from late July to the end of October which was then followed by a quick November rally that helped the market recover about 80% of those losses. Most of the indicators are signaling continued weakness through the end of the year but the recent rally has some indicators getting close to turning positive. We continue to monitor these signals and indicators to make the necessary adjustments to our strategies.

- CPI REMAINED THE SAME AS LAST MONTH: The latest CPI number remained at 3.2%, which was the same level reported in October. The latest inflation rates mean that the FED is likely to keep rates unchanged. Many forecasts are now predicting no more rate increases and possible rate decreases beginning sometime mid-next year.

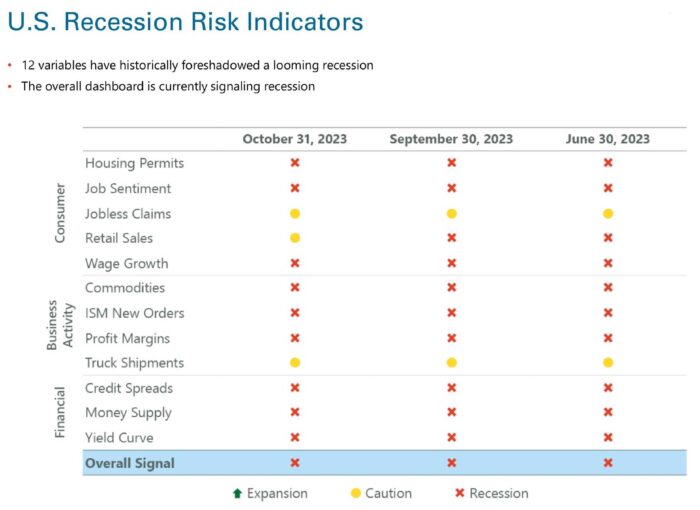

- LATEST ECONOMIC INDICATORS: As of October 31st, the recession indicators remain unchanged with 10 indicators signaling Recession and two signaling Caution. The probability of a recession within the next 6-9 months ticked up a bit higher to 68%.

Below are the latest economic recession indicators as of October 31st.

All the best,

Matt Deaton, Managing Partner

Acute Wealth Advisors

4856 E. Baseline Rd., Suite 104 | Mesa, AZ 85206

P: (480) 620-6907 | F: (800) 537-4185

Investment advisory services offered through Acute Investment Advisory, a Registered Investment Advisor. Insurance and annuities offered through Acute Wealth Advisors, LLC.