Newsletter

NEWSLETTER: MAY 2024

Tuesday, May 21st

Dear Valued Client:

Brief Market Update: Please take a few minutes to read some brief comments on the markets and the current economic recession indicators.

- CPI CAME IN ABOVE EXPECTATIONS: The latest CPI number came in at 3.4% which met market expectation but still remains higher than the FED’s goal of 2%. The current reading was down from 3.5% the month before. Concerns about inflation coming back or the economy entering a period of stagflation remain.

- RATE DECREASES UNLIKELY UNTIL LATER IN THE YEAR: Beginning in 2024, it was expected that the FED would drop rates 6-7 times. Markets are now only predicting 2 rate decreases with many economist expecting the first rate decrease not to begin until the second half of the year.

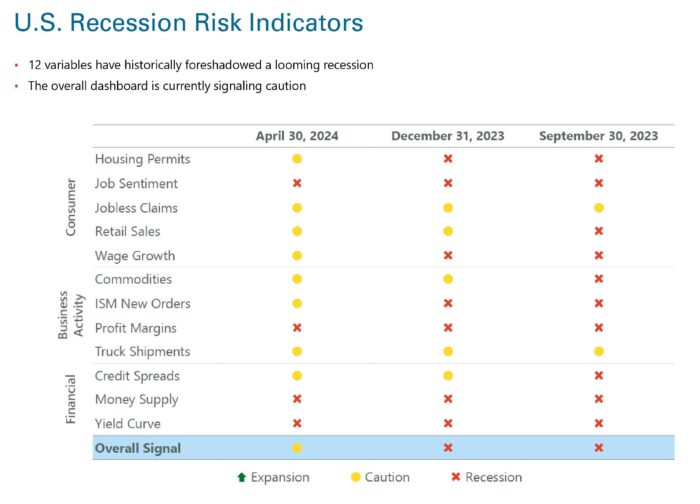

- LATEST ECONOMIC INDICATORS: As of April 30th, the recession indicators show four indicators signaling Recession and eight signaling Caution. The probability of a recession within the next 9-12 months remains at 52%.

Below are the latest economic recession indicators as of April 30th.

All the best,

Matt Deaton, Managing Partner

Acute Wealth Advisors

4856 E. Baseline Rd., Suite 104 | Mesa, AZ 85206

P: (480) 620-6907 | F: (800) 537-4185

Investment advisory services offered through Acute Investment Advisory, a Registered Investment Advisor. Insurance and annuities offered through Acute Wealth Advisors, LLC.